CloudComp tracks every commission payout by user, date, deal record, compensation plan, attainment percentage, and more — providing a transparent audit trail that meets enterprise and regulatory standards.

Finance Solutions

Why do Finance Teams Trust CloudComp?

CloudComp ensures accurate, auditable, and secure commission management with full visibility into payouts, rate structures, and attainment. Finance leaders can forecast confidently and close books faster — with full Salesforce integration.

CloudComp supports draws, clawbacks, and adjustments

CloudComp automates complex financial operations like recoverable and non-recoverable draws, clawbacks, and manual or rule-based adjustments — all within a secure Salesforce-native framework.

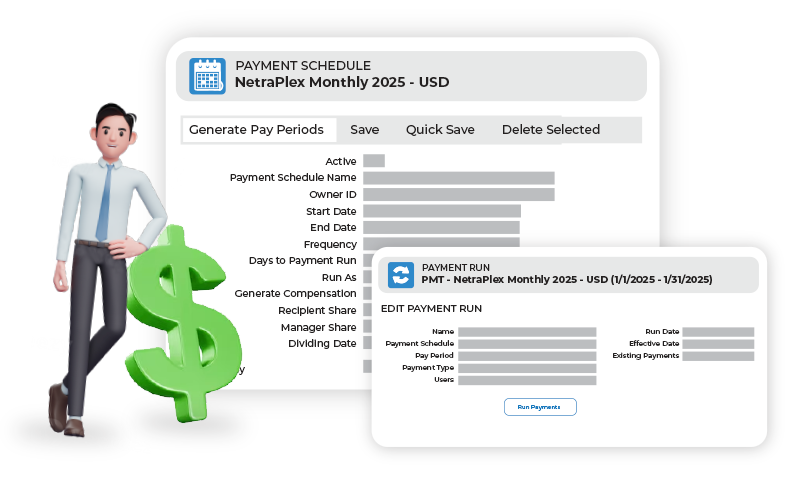

CloudComp handles multi-currency payouts

CloudComp fully supports Salesforce Advanced Currency Management, including dated exchange rates. It ensures payouts are calculated and reported correctly by user, country, and plan currency — all within compliance and audit standards.

CloudComp is suitable for compliance and audit

CloudComp for Finance FAQ

How does CloudComp ensure payout accuracy?

Every payment includes detailed lines showing the deals, tiers, and rules behind it. Finance teams get full transparency, audit-ready data, and error-free reconciliation.

What about clawbacks and true-ups?

CloudComp automates adjustments for clawbacks, true-ups, balance forward, and carryover — eliminating manual corrections and disputes.

Can we support multiple currencies?

Yes. CloudComp supports Salesforce multi-currency, dated FX rates, and corporate roll-ups, giving you accurate global reporting.

How are draws handled?

Both recoverable and non-recoverable draws are supported, with clear visibility in payment statements.

How fast can we close payroll?

Automated and scheduled payment runs with built-in adjustments mean faster closes and fewer disputes.

What happens if plans or quotas change mid-year?

- CloudComp applies changes cleanly while preserving history.

- CloudComp Forecasting and Modeling lets Finance test the impact of changes before approval.

- Surfwriter Professional Services is available for comprehensive, vendor-led implementations and transitions.

How does CloudComp reduce commission disputes?

- The CloudComp data, reports and payment summaries are granular and detailed, empowering sales reps to see where every quota attainment or commission record was counted and how they were credited.

- When questions come up they can be easily answered and updates to sales data records or commission rules can be rapidly accomplished by Administrators if changes are required.

- Finance receives fewer disputes and closes faster with confidence.